You are here:Aicha Vitalis > bitcoin

What Can Affect Investment Portfolio Value: Binance Answers

Aicha Vitalis2024-09-21 05:34:59【bitcoin】4people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Investing in the financial markets can be an exciting endeavor, but it is also crucial to understand airdrop,dex,cex,markets,trade value chart,buy,Investing in the financial markets can be an exciting endeavor, but it is also crucial to understand

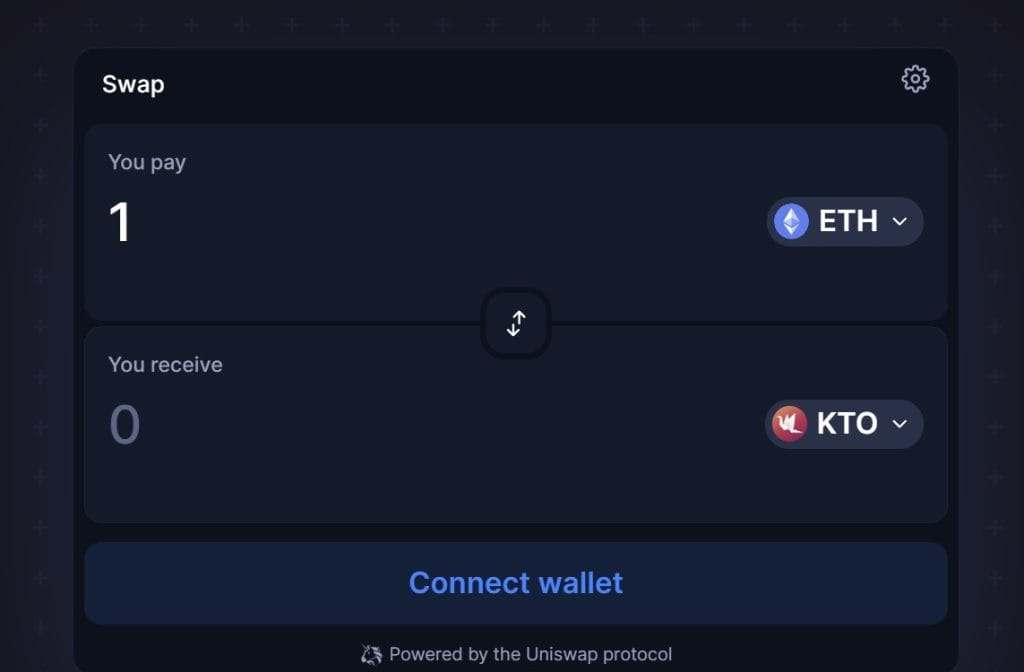

Investing in the financial markets can be an exciting endeavor, but it is also crucial to understand the factors that can affect the value of your investment portfolio. Binance, being one of the leading cryptocurrency exchanges, has provided valuable insights on what can affect investment portfolio value. In this article, we will explore the various factors that can impact your investment portfolio and how Binance answers these questions.

1. Market Volatility

One of the most significant factors that can affect investment portfolio value is market volatility. The cryptocurrency market, in particular, is known for its high volatility, which can lead to significant price fluctuations in a short period. Binance acknowledges this and suggests that investors should be prepared for such volatility. They advise diversifying their portfolio to mitigate the risk associated with market fluctuations.

2. Economic Factors

Economic factors, such as inflation, interest rates, and economic growth, can also impact the value of your investment portfolio. Binance emphasizes that investors should stay informed about the economic landscape to make informed decisions. By keeping an eye on economic indicators, investors can anticipate potential changes in market conditions and adjust their portfolios accordingly.

3. Regulatory Changes

Regulatory changes can have a profound impact on the value of your investment portfolio. Governments around the world are continuously working on creating policies and regulations to govern the cryptocurrency market. Binance answers this question by reminding investors to stay updated with the latest regulatory news. By doing so, investors can avoid unexpected losses due to sudden regulatory changes.

4. Technological Advancements

Technological advancements can also affect the value of your investment portfolio. Innovations in blockchain technology, for example, can lead to the rise of new cryptocurrencies and the decline of existing ones. Binance suggests that investors should stay informed about technological developments and be willing to adapt their portfolios accordingly.

5. Risk Management

Risk management is a crucial aspect of investing. Binance answers the question of what can affect investment portfolio value by emphasizing the importance of diversification and risk assessment. They advise investors to diversify their portfolios across various asset classes, including cryptocurrencies, stocks, bonds, and commodities. This diversification helps in reducing the impact of any single asset's performance on the overall portfolio value.

6. Market Sentiment

Market sentiment can significantly impact the value of your investment portfolio. Binance acknowledges that emotions can drive market movements and suggests that investors should remain disciplined and avoid making impulsive decisions based on market hype or panic. By staying focused on their investment strategy, investors can navigate market sentiment fluctuations more effectively.

In conclusion, several factors can affect the value of your investment portfolio. Binance provides valuable insights on what can affect investment portfolio value, including market volatility, economic factors, regulatory changes, technological advancements, risk management, and market sentiment. By understanding these factors and staying informed, investors can make more informed decisions and protect their portfolios from potential risks.

This article address:https://www.aichavitalis.com/btc/50f2699923.html

Like!(84)

Related Posts

- Bitcoin Mining Software for PC: A Comprehensive Guide

- How to Convert USDT to BNB in Binance: A Step-by-Step Guide

- The Safest Way to Create a Bitcoin Wallet

- How to Transfer Crypto on Binance: A Step-by-Step Guide

- **Building Your First Bitcoin Mining Rig: A Starter Guide

- How to Transfer Crypto on Binance: A Step-by-Step Guide

- How to Connect MetaMask to Binance Smart Chain: A Step-by-Step Guide

- Bitcoin Price March 10, 2017: A Look Back at a Historic Day in Cryptocurrency

- Bitcoin Wallet Used in Ecuador: A Gateway to Financial Freedom

- How to Transfer from Coinbase to Binance: A Step-by-Step Guide

Popular

Recent

What is Bitcoin Wallet Blockchain?

How Much for a Bitcoin Mining Machine: A Comprehensive Guide

Can You Make a Living Mining Bitcoin?

How to Transfer from Coinbase to Binance: A Step-by-Step Guide

How to Send BTC from Binance to Trust Wallet: A Step-by-Step Guide

How to Convert USDT to BNB in Binance: A Step-by-Step Guide

Best Coin for Day Trading in Binance: Unveiling the Ultimate Choice

How to Transfer Crypto on Binance: A Step-by-Step Guide

links

- Where Do I Find My Bitcoin Cash Address?

- S10 Bitcoin Wallet: The Ultimate Guide to Securely Managing Your Cryptocurrency

- Can I Use Binance Global in the US?

- Bitcoin Mining Companies Penny Stocks: A Lucrative Investment Opportunity

- How Many Binance Accounts Can You Have?

- Where Do I Find My Bitcoin Cash Address?

- Title: Integrating Binance Smart Chain: A Comprehensive Guide to Adding Binance Smart Chain

- Can You Buy a House with Bitcoin in the US?

- Title: Exploring Alternatives to the Buy Bitcoin Cash App

- Kostenloses Bitcoin Mining: The Pros and Cons